Global supply chain stability is wavering but Asia Pacific going okay

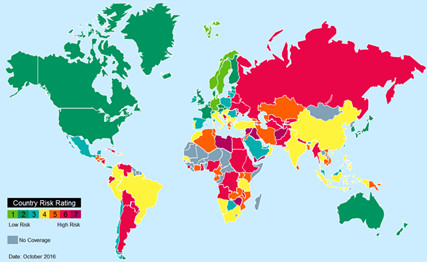

The CIPS Risk Index, produced for the Chartered Institute of Procurement & Supply (CIPS) by Dun & Bradstreet economists, tracks the impact of economic and political developments on the stability of global supply chains.

The latest index shows risk relating to global supply chains has reached its highest levels since 2013 due to a convergence of international issues including uncertainty around the post-Brexit relationship between the UK and the European Union as well as economic and political instability across the Middle East. The upward trend in supply chain risk can be partly attributed to a breakdown in political consensus over globalisation, with the World Trade Organisation reporting an average of 22 new trade restrictive measures introduced each month in its latest report.

Region-specific results show highest increases in risk:

- Western Europe

- Eastern Europe

- Central Asia

- Middle East

- North and Sub-Saharan Africa

Improved risk:

- Asia Pacific

According to Bodhi Ganguli, lead economist, Dun & Bradstreet, the CIPS Risk Index reflected the general unease about the state of the global economy with its increase in operational risk.

“Political and economic uncertainties — such as the extent of the growth slowdown in China, emerging markets’ financial vulnerabilities, the impact of terrorism on cross-border movements and the fallout from Brexit — continue to weigh on global business sentiment,” Ganguli said.

In addition, growing disillusionment with globalisation is contributing to political risk. Elections over the next 12 months are expected to see gains for far-right parties across the globe. Incumbent governments are also demonstrating worrying responses to the growing issue of cross-border movements with the Australian government proposing radical changes to immigration policy in response to perceived terrorist threats stemming from violence in the Middle East.

All told, increased political and economic risk globally is beginning to affect the bottom line of businesses as they look to navigate an increasingly hostile global trade and supply market.

Mark Lamb, general manager of CIPS Asia Pacific, said: “Supply chain managers are facing a new wave of impediments to the flow of goods across borders. With international trade deals under threat around the world, supply chain managers must be as aware of political risks as they are of natural disasters and economic hardship.”

Asia Pacific has bucked the global trend with slight improvements in risk levels for domestic businesses. Australian suppliers in particular have benefited from rising coal and iron ore prices together with an increase in national defence spending. In the short term, Australian businesses are also showing improved payment performance. Of concern is a continued reliance on an unstable Chinese economy. A major issue likely to have deep effects on Asian trade is the recent bankruptcy of South Korea’s Hanjin Shipping. Responsible for 3% of global shipping, it has left cargo as large as $14bn unable to dock. The bankruptcy is likely to have wide-ranging impact on transpacific and Asia–Europe supply chains.

More about the CIPS Risk Index

The CIPS Risk Index analyses the socioeconomic, physical trade and business continuity factors contributing to supply chain risk across the world, weighting each score according to that country’s contribution to global exports.

The index helps sourcing professionals understand the risks to which their supply chains are exposed, articulate questions and scenarios for key suppliers, inform assurance activities, check the readiness of contingency plans, support the negotiation of risk transfer in contracts and establish factors which may impact the financial stability of tier-one and sub-tier suppliers upstream. Regular production of this index will help procurement and supply professionals communicate and justify risk-informed sourcing decisions.

A full copy of the latest CIPS Global Risk Survey can be found here.

Kardex opens office in Sydney

Swiss Intralogistics solutions provider Kardex has opened its Australian office in Sydney, with...

Starting the conversation about Australia's food security future

AFGC has highlighted urgent supply chain and manufacturing pressures in its submission to the...

Fine Food recap: success for Australian food logistics business

The Fine Food exhibition in Sydney was a resounding success for CoolPac's Olivo insulated...