Global dairy market remains calm despite pandemic

Australia and New Zealand dairy supplier Maxum Foods has provided a global dairy commodity update amid surging COVID-19 infections and stringent lockdown measures seen worldwide.

The report said that apart from the ongoing turbulence in the US cheese market, global dairy markets have remained calm despite the pandemic.

However, dairy market fundamentals are mixed across major producers, and regional factors continue to influence the value directions in commodities.

The effects of the first wave of COVID outbreaks — from lockdowns and their roll-back — had limited overall impact on dairy demand, helped by the resilience of sales through grocery channels. This was also cushioned in Europe by summer demand for cream, which avoided large butter surpluses.

Second wave case outbreaks are far larger in scale than in the second quarter of this, yet governments will take a mixed response in applying restrictions — some avoiding unpopular lockdowns.

The report predicts the adequacy of retail demand will be tested as governments now offer less income support, and the closure of foodservice outlets will weaken cream use.

There is an uncertain volume impact of more cautious discretionary spending on the dairy category. Meanwhile, commodity prices have recovered, and dairy commodity buyers in price-sensitive export markets will face a more complex economic outlook and may not have the need or incentive to restock.

Maxum Foods said the risk of further stock-build in butterfat depends on the resilience of cheese demand in the European Union and the United States as well as the prospects for increased exports.

There will be an ongoing slow and bumpy recovery in foodservice channels while business and tourism travel and events will be limited through much of 2021.

Milk growth picked up recently but won’t be sustained through coming months (outside the US) as weather and feed costs will start to impact milk production in several regions.

Global trade remained ahead of the prior year in August but slower than each of the previous two months.

The year-on-year growth across major commodity categories was lower in most cases. Butterfat trade was most impacted — August trade fell by a combined 11%.

Below are the report’s analyses of specific markets.

Skim milk powder (SMP)

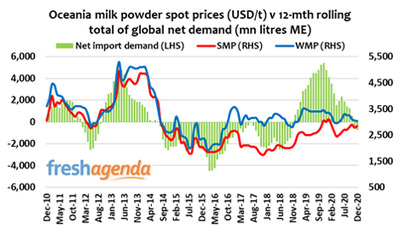

Spot prices for SMP have been mixed recently — steady in New Zealand since mid-September, weaker in the US as milk supply expands and firmer in the EU.

Whole milk powder (WMP)

Prices for WMP have stabilised in the past few months, with EU and NZ product converging and trading around the US$3000 mark. At the earliest October GDT event, WMP values gained, steadying at the latest event.

Cheese

Cheese values in the US gained through October, while NZ and EU prices have steadied with EU values remaining competitive. US first-quarter 2021 futures prices have also increased with the rampant spot market, but once additional supplies are available, futures prices suggest a large correction.

Butter

Butterfat trade fell 10.8% in overall terms, pulled lower than the prior month’s decline by a 20% fall in AMF trade, while butter trade worsened a little to fall 6.8%. This came despite a continuing slide in NZ average shipped prices, while EU values continued to increase.

Whey

Whey product values were steady through October and remain under the complex influences of COVID-19 on milk supplies, the prospects for increasing cheese output, relative SMP prices and weak demand for high-concentrate products as infant formula trade remained subdued and fitness markets have been closed down due to movement restrictions.

AFGC reviews progress on food and grocery manufacturing targets

In its latest food and grocery manufacturing sector report, AFGC reflects on the...

$15m AI space project to help boost Australian agriculture

The Australasian Space Innovation Institute is developing an AI-enabled geospatial national...

Barry Callebaut opens chocolate innovation centre in Singapore

The Callebaut Global Innovation Center is helping to advance the future of chocolate and cocoa...